What is Accounting?

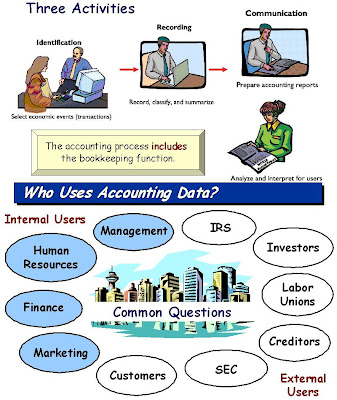

The purpose of accounting is to:

(1) identify, record, and communicate the economic events of an

(2) organization to

(3) interested users.

TheBuilding Blocks of Accounting

Ethics In Financial Reporting:

Standards of conduct by which one’s actions are judged as right or wrong, honest or dishonest, fair or not fair, are Ethics.

1. Recent financial scandals include: Enron, WorldCom, HealthSouth, AIG, and others.

2. Congress passed Sarbanes-Oxley Act of 2002.

3. Effective financial reporting depends on sound ethical behavior.

Cost Principle (Historical) – dictates that companies record assets at their cost.

Issues:

1. Reported at cost when purchased and also over the time the asset is held.

2. Cost easily verified, whereas market value is often subjective.

3. Fair value information may be more useful.

Assumptions

Monetary Unit Assumption – include in the accounting records only transaction data that can be expressed in terms of money.

Economic Entity Assumption – requires that activities of the entity be kept separate and distinct from the activities of its owner and all other economic entities.

1. Proprietorship.

2. Partnership.

3. Corporation.

Provides the underlying framework for recording and summarizing economic events.

Assets are claimed by either creditors or owners.

Claims of creditors must be paid before ownership claims.

Assets

1. Resources a business owns.

2. Provide future services or benefits.

3. Cash, Supplies, Equipment, etc.

Liabilities

1. Claims against assets (debts and obligations).

2. Creditors - party to whom money is owed.

3. Accounts payable, Notes payable, etc.

Owners’ Equity

1. Ownership claim on total assets.

2. Referred to as residual equity.

3. Capital, Drawings, etc. (Proprietorship or Partnership).

Revenues result from business activities entered into for the purpose of earning income.

Common sources of revenue are: sales, fees, services, commissions, interest, dividends, royalties, and rent.

Expenses are the cost of assets consumed or services used in the process of earning revenue.

Common expenses are: salaries expense, rent expense, utilities expense, tax expense, etc.

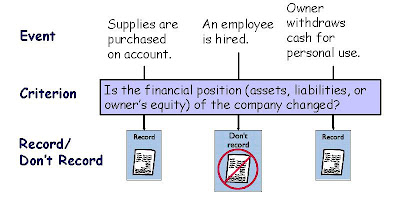

Are the following events recorded in the accounting records?

Problem:-

Barone’s Repair Shop was started on May 1 by

1. Invested $10,000 cash to start the repair shop.

2. Purchased equipment for $5,000 cash.

3. Paid $400 cash for May office rent.

4. Received $5,100 from customers for repair service.

5. Withdrew $1,000 cash for personal use.

6. Paid part-time employee salaries of $2,000.

7. Incurred $250 of advertising costs, on account.

8. Provided $750 of repair services on account.

9. Collected $120 cash for services previously billed.

Demonstration Problem

Joan Robinson opens her own law office on

- Invested $10,000 in cash in the law practice.

- Paid $800 for July rent on office space.

- Purchased office equipment on account $3,000.

- Provided legal services to clients for cash $1,500.

- Borrowed $700 cash from a bank on a note payable.

- Performed legal services for a client on account $2,000.

- Paid monthly expenses: salaries $500, utilities $300, and telephone $100.

Instructions

(a) Prepare a tabular summary of the transactions.

(b) Prepare the income statement, owner's equity statement, and balance sheet at July 31 for Joan Robinson, Attorney at Law.